- Fully Shariah Compliant Card

- Free credit facility up to 55 days

- Globally accepted all over the world with strong network

- Enjoy exciting discounts that includes fine dining, shopping & world-class travelling

- High annual fee

- Cost of borrowing is high

- Beware of late fees charges involved with this card

- Offers you complementary lifestyle combined with a number of high-end benefits

- Enjoy complimentary access to over 1,000+ airport lounges Worldwide

- Withdraw advance cash from Credit Card and pay into easy installments

- 0% Installment plan is available on various products with no early settlement charges

- Enjoy free visits for four months at Karachi Golf Club

- Redeem your reward points over 300+ retail partners outlets

- Avail wonderful discounts on Careem and Cleartrip

- Strong Mastercard network globally accepted

Salaried Person:

- Minimum Salary Requirement: Rs 500,000

- Age Limit: 18 - 65 years

- Documents required: CNIC, Salary slips, Bank statement, Letter from employer

Self-Employed / Businessmen:

- Minimum income: Rs 500,000

- Age Limit: 18 - 65 years

- Documents required: CNIC, NTN, Proof of business, Bank statement

Maximum Credit Limit

500,000

Interest Free Period

55 Days

Balance Transfer Rate

32.4%

Cash Advance Fee Annual (PKR)

1,000 or 3% whichever is higher

Cash Advance Rate (%)

39

Rewards Program

Reward Points

Reward Points

3x reward point on Donations & Charities

Late Payment Fee (PKR)

1,500

Foreign Transaction Fee (PKR)

3.5%

Targeted For

Salaried Person and Businessmen

Min. Income for Salaried (PKR)

500,000

Min. Income for Businessman (PKR)

500,000

Best Suitable For

Frequent travelers

Minimum Age (Years)

18 Years

No. of Supplementary Cards

-

Payment Network

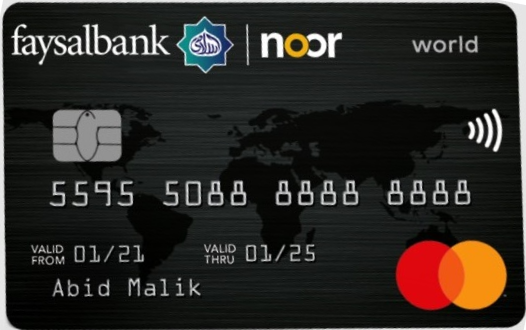

Mastercard

Loung Access

Local & International Airports lounges