The objective of this fund is to provide you a reasonable profit on your investment with maximum preservation of your principal amount.

- Get stable returns and safe investment opportunity

- Get better returns as compared to other saving options

- Withdraw your investment without any penalty

- Withdraw cash with an NBP card through any ATM

- Offering optional life and accidental insurance coverage

- Withdraw your cash through Debit Card any time

- Managed by experienced fund managers in Pakistan

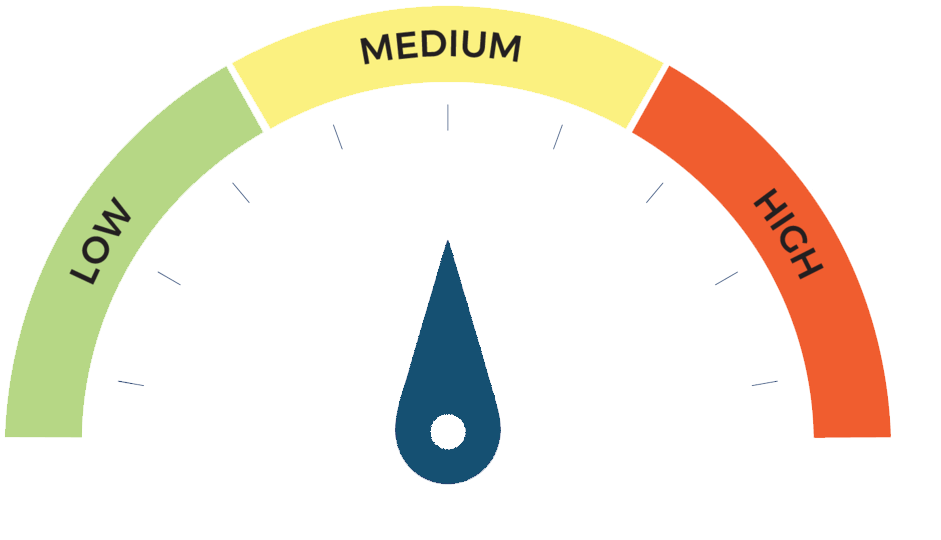

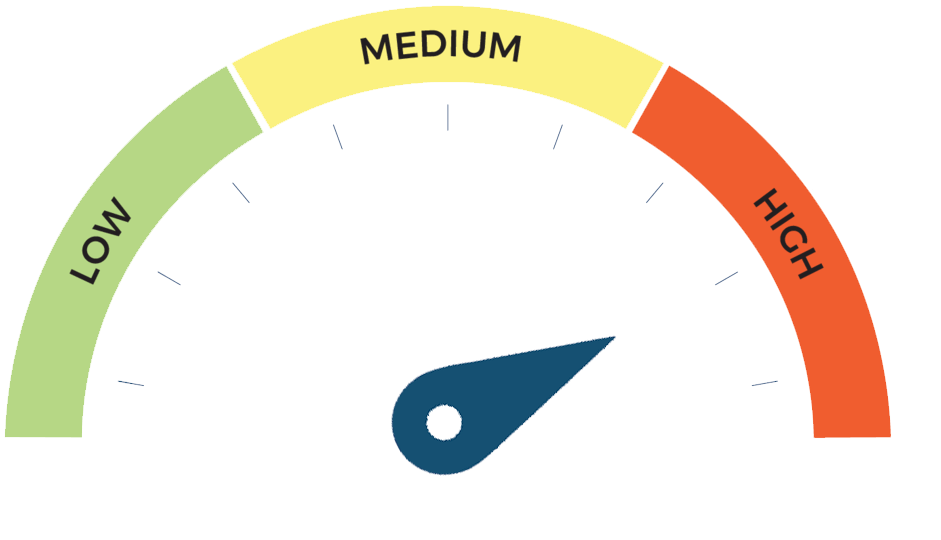

Offers you an investment opportunity with the medium risk that helps you to grow your savings with very minor risk. In this fund, your capital can only be invested in high rate Government Bonds and high rates Debt securities.

- Age Limit: Above 18 years

- Information required: CNIC, Bank Account Number, Mobile phone and email address

Fund Size:Rs. 10,254 Million Fund Size:Rs. 10,254 Million |

Age: 19 years 2 m Age: 19 years 2 mSince 21 Apr 2006 |

Front Load:Up to 3% Front Load:Up to 3% |

Exit Load:Nil Exit Load:Nil |

Management Fee: 6% Management Fee: 6% |

Min. Investment: Min. Investment:

Rs. 10000 |

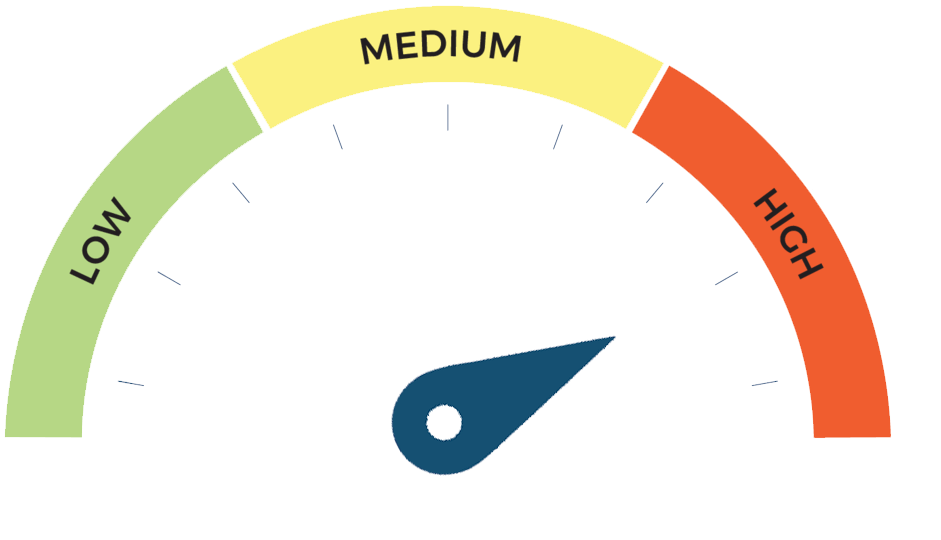

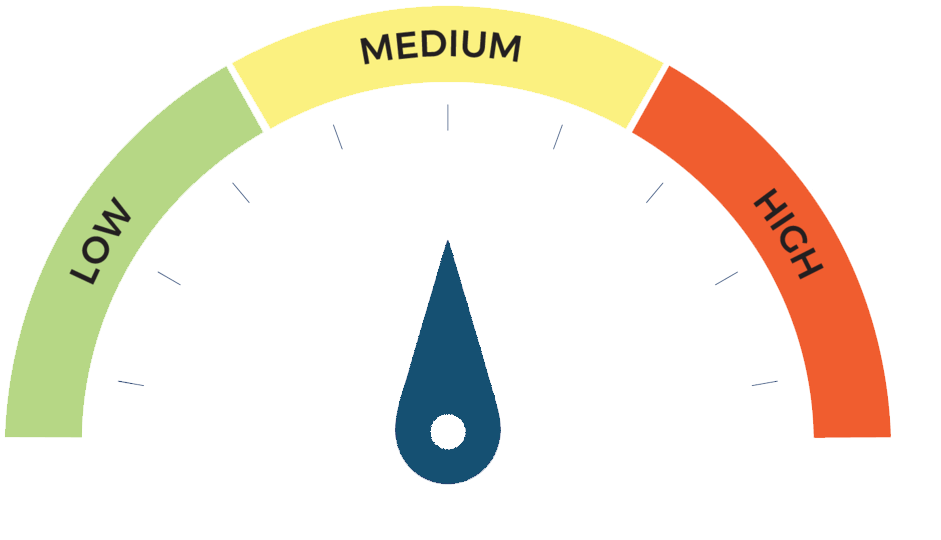

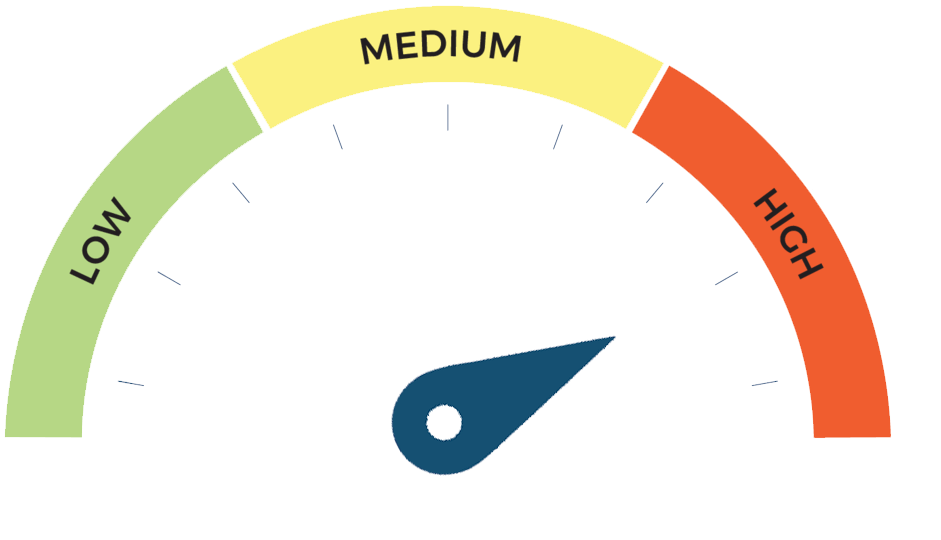

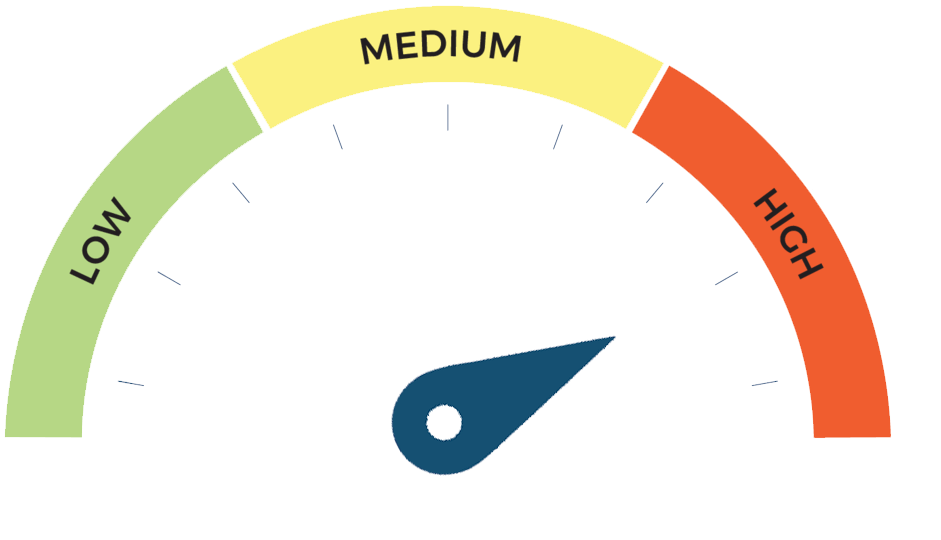

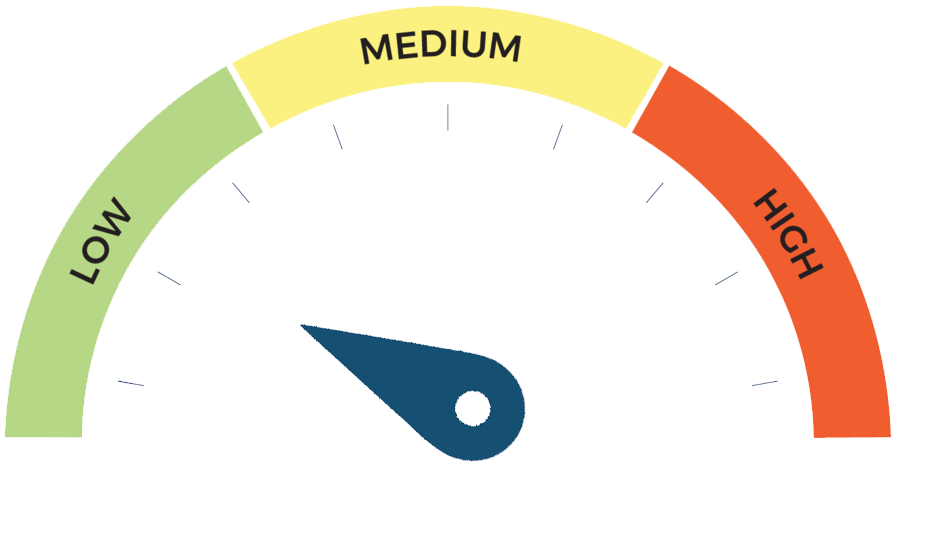

Investors understand that their principal will be

at Medium risk

Fund Type

Open End Income Fund

Fund Size

10,254 Million

Fund Rating

-

AMC Rating

AM1

Launch Date

21 April 2006

Front End Load

Up to 3%

Exit Load

Nil

Management / Admin Fee

6%

Redemption / Withdraw Charges

-

Tax Benefits

Yes

Validity Date 01 Jan 1970

Daily Nav

-

1 month Nav

-

15 Days Nav

-

Month To Date

-

3 Month

-

6 Month

-

1 Year

-

Year To Date

-

3 Year

10.00

5 Year

8.30

Fund Performance

Risk Type

Risk Type

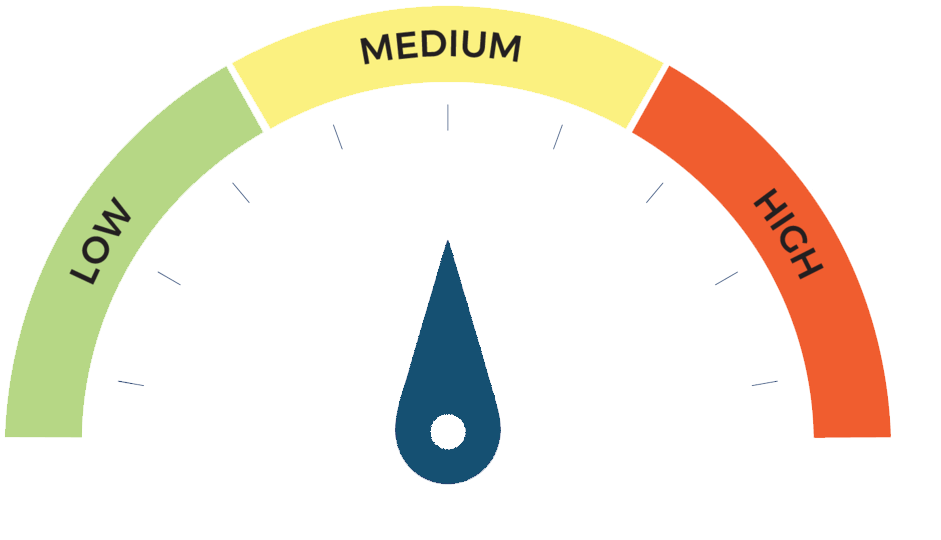

Fund Performance

Risk Type

Risk Type

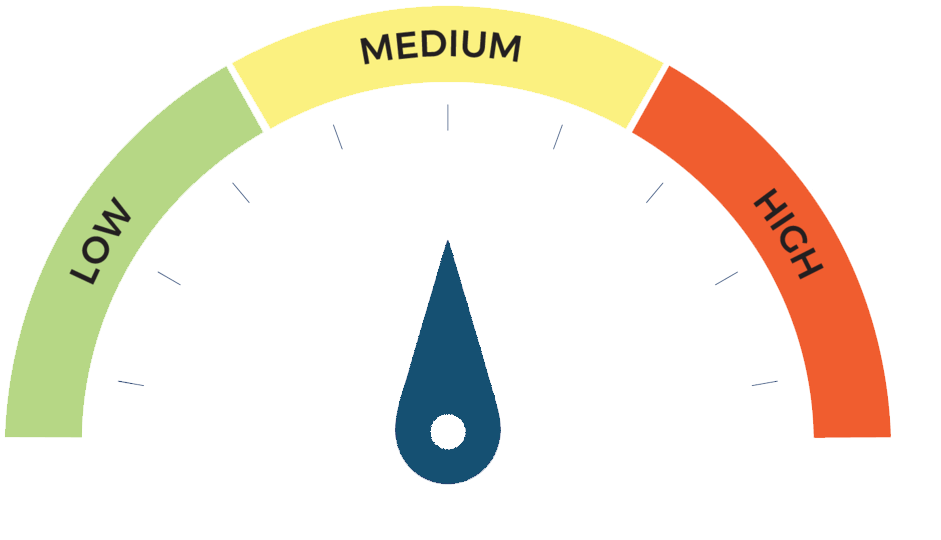

Fund Performance

Risk Type

Risk Type

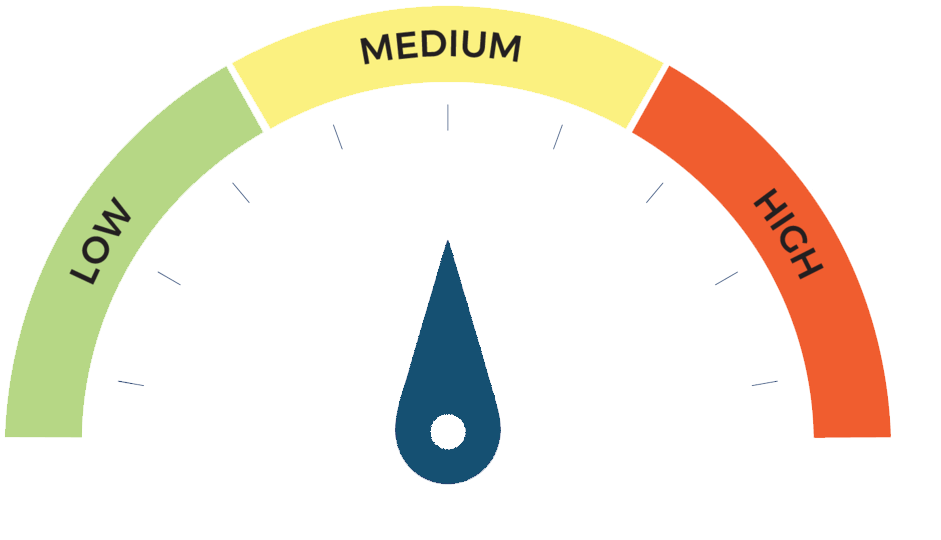

Fund Performance

Risk Type

Risk Type

Fund Performance

Risk Type

Risk Type

Fund Performance

Risk Type

Risk Type

Fund Performance

Risk Type

Risk Type

Fund Performance

Risk Type

Risk Type

Fund Performance

Risk Type

Risk Type

Fund Performance

Risk Type

Risk Type

Fund Performance

Risk Type

Risk Type

Fund Performance

Risk Type

Risk Type

Fund Performance

Risk Type

Risk Type

Fund Performance

Risk Type

Risk Type

Fund Performance

Risk Type

Risk Type

Fund Performance

Risk Type

Risk Type

Fund Performance

Risk Type

Risk Type

© Copyright 2025 MAWAZNA.com . All rights reserved. Use of this site constitutes acceptance of our Terms of Use and Privacy Policy.

The content provided by Mawazna.com is based on indicative information ONLY. The integrity of the information is reviewed and validated at regular intervals using the information available from free sources (websites, product catalogs) provided by banks/service providers and their helpdesk however product information, service charges, rates & fees are subject to change on time to time basis. Mawazna.com takes no responsibility of any such changes or any consequences arising from the use of or reliance on the content presented in this website. Therefore it is highly recommended that you should also make direct enquiries to the product providers/banks before buying a product. We aim to serve you impartially.

© Copyright 2025 MAWAZNA.com - All Rights Reserved